Credit lines from $1,000 to $10,000

Build credit in company name*

No hard credit check

No annual fee

*with no personal guarantee

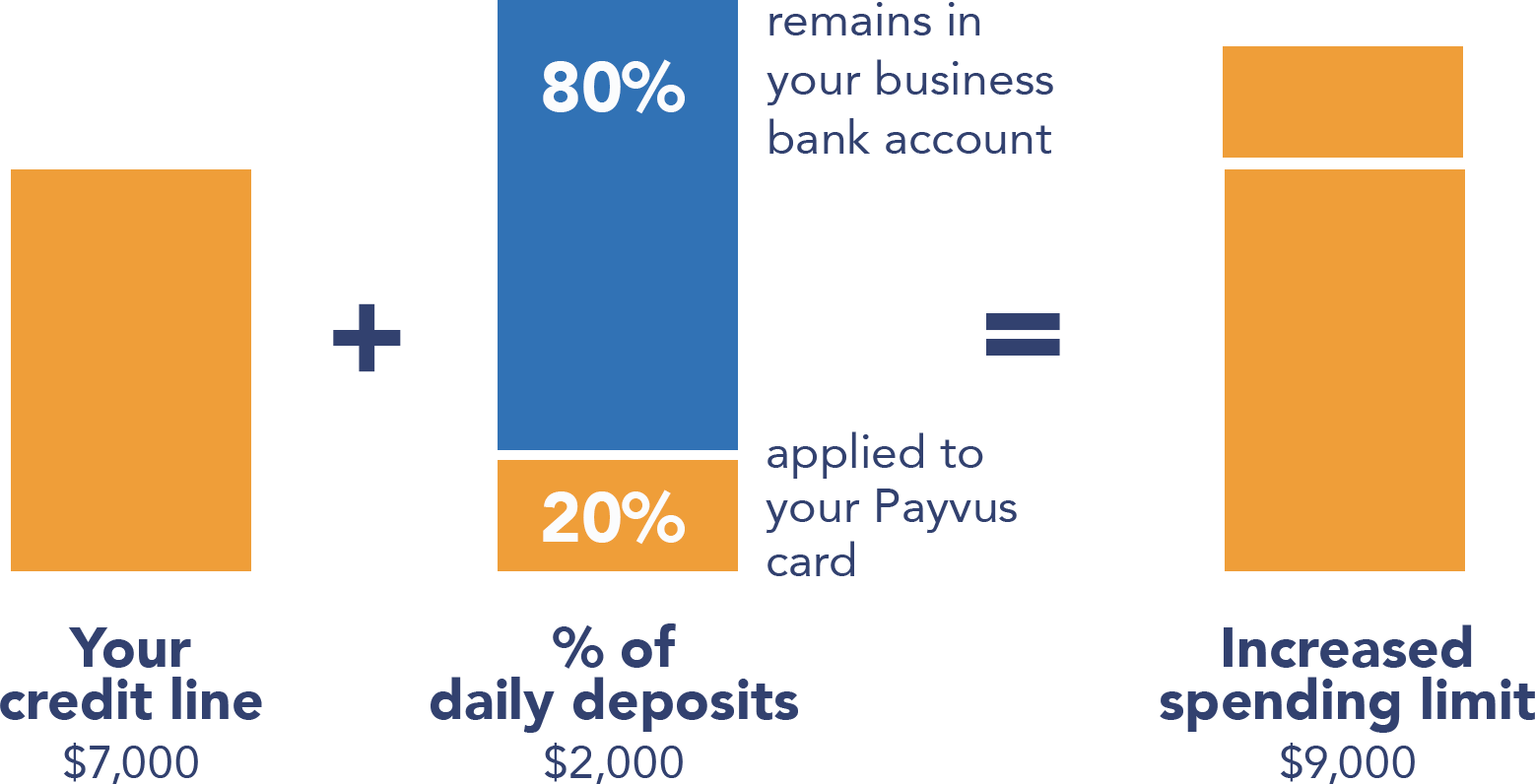

Sell your way to buying power

How do I increase my spending limit?

Funds will be drawn from your bank account and applied as a payment to your Payvus card every day, starting the day you activate your card. Whenever you have a zero balance on your card, funds from this daily draw accumulate, increasing the amount available to spend and increasing your spending limit.

How do I increase my spending limit?

Payvus supports entrepreneurs and growing companies in a range of industries. Whether you’re keeping the office stocked with supplies or planning for capital investment, Payvus can help your company sustain growth and realize its potential.

Steven Addario, Owner

Addario Services

I paid off two personal credit cards that I had been using to pay for business expenses. And Payvus increased my credit limit five-fold.